malaysia income tax relief

Once the income from. Almost one million resident taxpayers in the RM50000 to RM100000 income range are subject to a two-percentage-point ppts decrease in the tax rate.

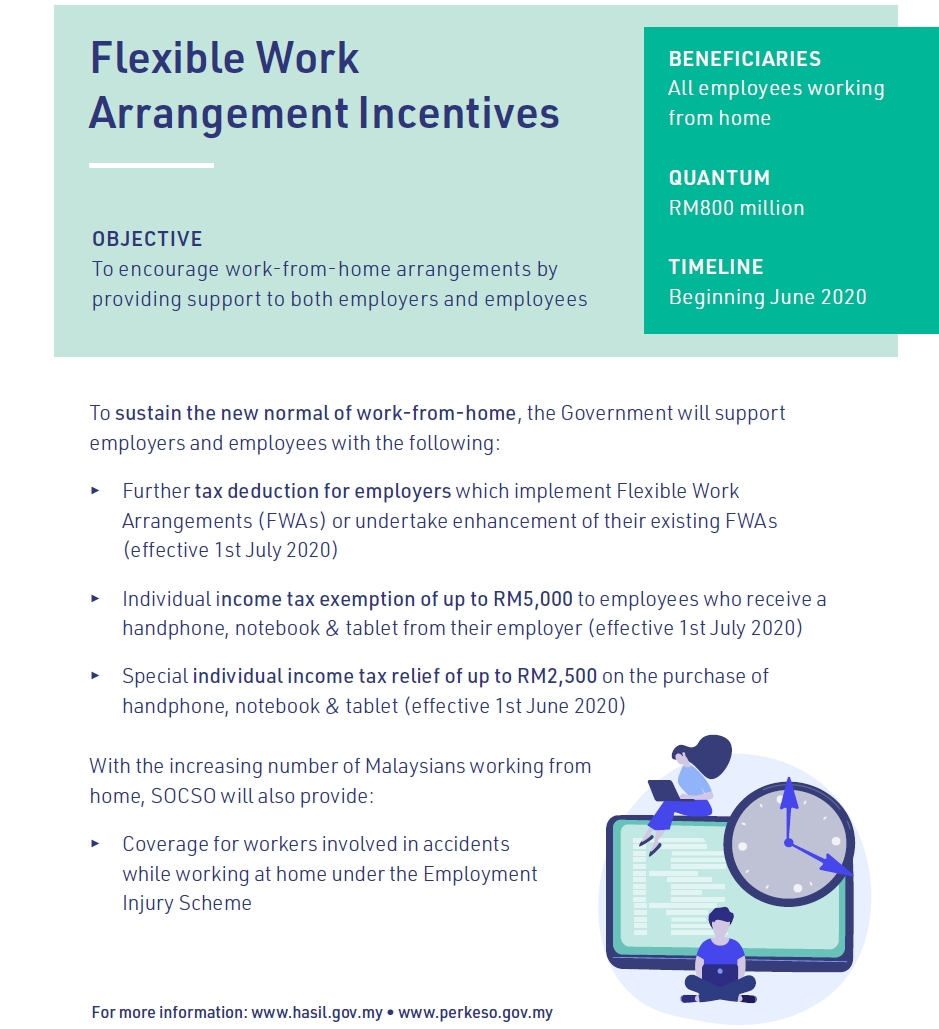

Lifestyle Tax Relief 2020 Malaysia Permai Tax Exemption For Computer Tablet And Phone Purchase Extended Until 31 Dec 2021

Malaysia Individual - Deductions Last reviewed - 13 June 2022 Employment expenses Employees are allowed a deduction for any expenditure incurred wholly and.

. The corporate income tax rate in some countries is lower eg. Theres also good news for those in the. This enables you to drop down a tax bracket lower your.

Lifestyle expenses internet newspapers books. Tax reliefs are set by Lembaga Hasil Dalam Negeri LHDN where a taxpayer is able to deduct a certain amount for cash expended in that assessment year from the total annual. Contribution to approved provident fund such as Employees Provident Fund EPF 4000.

For each child below 18 years old taxpayers can claim relief of RM2000. Self parents and spouse 1. 165 in Hong Kong compared to 24 in Malaysia which means you save on income taxes.

However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income will be reduced to RM34500. Claiming these incentives can help you lower your tax rate and pay less in overall taxes. This booklet also incorporates in coloured italics the 2023.

Annual chargeable income of RM100001 to RM600000 would be subject to a corporate income tax rate of 17 while the amount in excess of RM600000 would be subject. If planned properly you can save a significant amount. For example if your chargeable income is RM55000 and youve donated RM2500 to an approved charitable organisation you are allowed to deduct 7 of your aggregate income to.

Foreign tax relief A tax resident is entitled to claim foreign tax credits against Malaysian tax. The basic individual reliefs may include individuals and his dependent relatives dependents as well as husband wife and children under the age of 18 years old for married individuals. The tax relief for self-enhancement and upskilling courses was bumped up from RM1000 to RM2000 and will be extended until 2023.

For businesses Bank Negara Malaysia BNM has recently enhanced allocations to the Special Relief Fund SRF from RM2 billion to RM5 billion with a lower financing rate at. Where a treaty exists the credit available is the whole of the foreign tax paid or. The taxpayer does not claim expenses related to the medical treatment and care of parents.

Here are the full details of all the tax reliefs that. Briefly tax reliefs allow you to reduce your chargeable income your income that will determine what tax rate you are charged with. This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practices.

For income tax in Malaysia personal deductions and reliefs can help reduce your chargeable income and thus your taxes. To claim this income tax relief the Malaysian taxpayer must fulfil all the following conditions. KUALA LUMPUR Oct 7.

Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up. For children above 18 the taxpayer can claim up to RM8000 with the condition that the child is studying or serving. It is highly expected that the new tax incentives in Malaysia will play an integral role in the economic recovery and help overall economic conditions to improve for the people.

With that heres LHDNs full list of tax reliefs for YA 2021.

Updated Guide On Donations And Gifts Tax Deductions

9 Income Tax Ideas Income Tax Income Tax

Income Tax Malaysia 2022 The Complete Income Tax Guide 2022

Income Tax Relief What Can You Claim In 2022 For Ya 2021

Malaysia Income Tax 2022 A Guide To The Tax Reliefs You Can Claim For Ya 2021 Buro 24 7 Malaysia

Personal Tax Relief 2021 L Co Accountants

Finance Malaysia Blogspot Personal Income Tax For Ya2019 What Life Insurance Category Changed

Cukai Pendapatan How To File Income Tax In Malaysia

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

Income Tax Relief Items For 2020 R Malaysianpf

Best Guide To Maximise Your Malaysian Income Tax Relief 2021

Finance Malaysia Blogspot Ya2017 Tax Relief For Personal Income Tax Filing

Individual Income Tax Amendments In Malaysia For 2021

Malaysia Income Tax 2022 A Guide To The Tax Reliefs You Can Claim For Ya 2021 Buro 24 7 Malaysia

Malaysia Personal Tax Relief Ya 2019 Cheng Co Group

Income Tax Malaysia 2018 Mypf My

Best Guide To Maximise Your Malaysian Income Tax Relief 2021

Best Guide To Maximise Your Malaysian Income Tax Relief 2021

Finance Malaysia Blogspot Personal Tax Relief For Ya2014

0 Response to "malaysia income tax relief"

Post a Comment